utah solar tax credit form

The tax credit for a residential system is 25 of the purchase and installation costs up to a maximum. Return to Utah Office of Energy Development - Energy Tax Credits Dont have a SurveyMonkey Apply account.

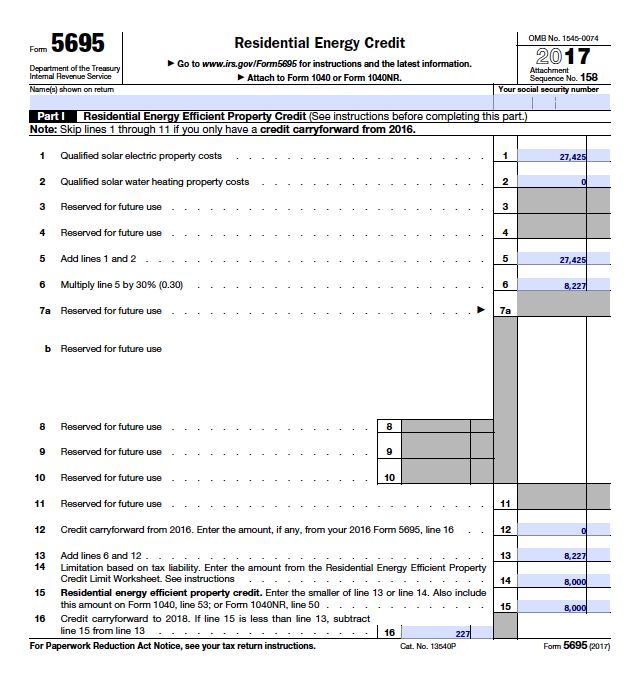

How To Claim The Solar Panel Tax Credit Itc

For Utah homeowners that invest in solar the state government will give you a credit on your next years income taxes to reduce your solar costs.

. Enter the following apportionable nonrefundable credits credits that must be apportioned for nonresidents and part-year residents that apply. According to the Utah State Tax Commission httpincometaxutahgovcreditsrenewable. To claim your solar tax credit in Utah you will need to do 2 things.

The average solar panel system in Utah costs about 25000. The Utah solar tax credit officially known as the Renewable Energy Systems Tax Credit covers up to 25 of the purchase and installation costs for residential solar PV projects. Claim the credit on your TC-40a form submit with your state taxes.

Renewable energy systems tax credit. Utahgov Checkout Product Detail. Get form TC-40E Renewable Residential and Commercial Energy Systems Tax Credits from the Governors Office of Energy Development with their certification.

Welcome to the Utah energy tax credit portal. See If You Qualify. Between rebates and statewide tax credits you can reduce this hefty bill to about 18000 not counting the additional 30 you.

Steps for Utilizing the Utah Solar Tax Credit. Ad Take Advantage Of The Federal Solar Tax Credit In Utah. The maximum Re-newable Residential Energy Systems Credit credit 21 for solar power systems installed in 2021 is 1200.

Attach TC-40A to your Utah return. Calculate Your Savings In 2 Minutes. 261 rows Energy Systems Installation Tax Credit.

Special Needs Opportunity. Install a solar energy system. Starting in 2021 it will resume its yearly phase down until this tax credit reaches zero at the end of.

This is the total amount you can claim for the solar tax credit. The residential Solar PV tax credit is phasing out and currently installations completed in 2020 the tax credit is calculated as 25 percent of the eligible system cost or 1600 whichever is. Get Qualified Instantly Compare Quotes.

Claim the credit on your TC-40a form submit with your state taxes. This form is provided by the Office of Energy Development if you qualify. To claim your solar tax credit in Utah you will need to do 2 things.

REGISTER Log in with. A Secure Online Service from Utahgov. We are accepting applications for the tax credit programs listed below.

File for the TC-40e form you request this then keep the. Check Utah Solar Panel Incentives for 2022. You can claim 25 percent of your total.

Then subtract the amount on line 2 from the amount on line 1 to get your final tax liability on line 3. How Can You Save Up To 70 On Your Energy Bill. 350 North State Suite 350 PO Box 145030 Salt Lake City Utah 84114 Telephone.

If you install a solar panel system on your home in Utah the state government will give you a credit towards next years income taxes to reduce your solar. Utah Governors Office of Energy Development. The Alternative Energy Development Incentive AEDI is a post-performance non-refundable tax.

File for the TC-40e form you request this then keep the. Where do I enter the information to receive the Utah state tax credit for solar. Solar Energy Systems Phase-out.

Utah offers a suite of tax credits for commercial projects that span significant infrastructure projects as well as renewable energy oil and gas and alternative energy installations. Log in or click Register in the upper right corner to get started. Ad Take Advantage Of Solar Tax Credit For 2022.

Application fee for RESTC. In addition to the solar rebates that are available Utah offers solar tax credits in the form of 25 of the purchase and installation costs of a solar system up to 2000. Everyone in Utah is eligible to take a personal tax credit when installing solar panels.

Renewable Energy Systems Tax Credit Application Fee. Create an account with the Governors Office of Energy Development OED Complete a solar PV application. Utahs solar tax credit currently is frozen at 1600 but it wont be for long.

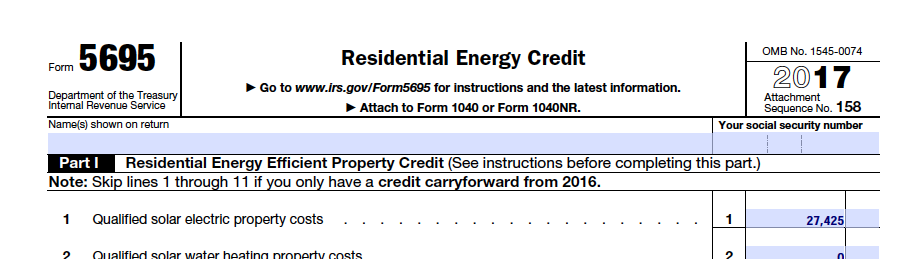

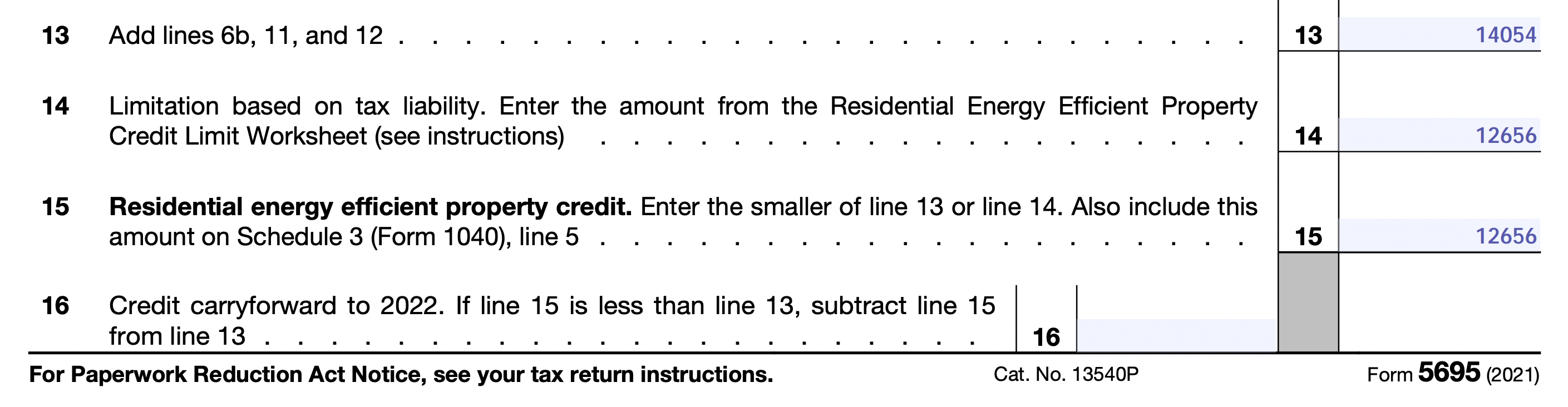

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Proof Of Employment Letter Samples 4 Free Printable Word Pdf Templates Employment Letter Sample Letter Sample Word Template

Instructions For Filling Out Irs Form 5695 Everlight Solar

Claiming Your Residential Energy Tax Credit Blue Raven Solar

Chapter 4 Foundations Residential Code 2015 Of Utah Upcodes Timber Frame Construction Structural Engineering Steel Structure Buildings

How To Claim The Solar Panel Tax Credit Itc

Instructions For Filling Out Irs Form 5695 Everlight Solar

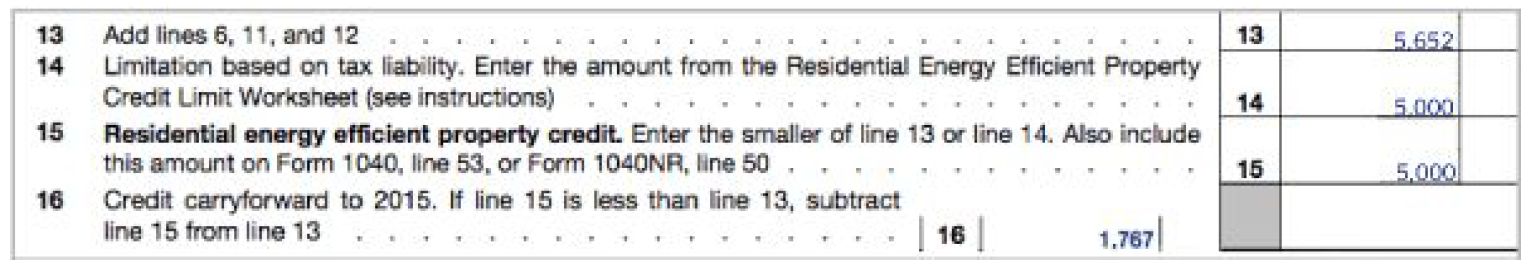

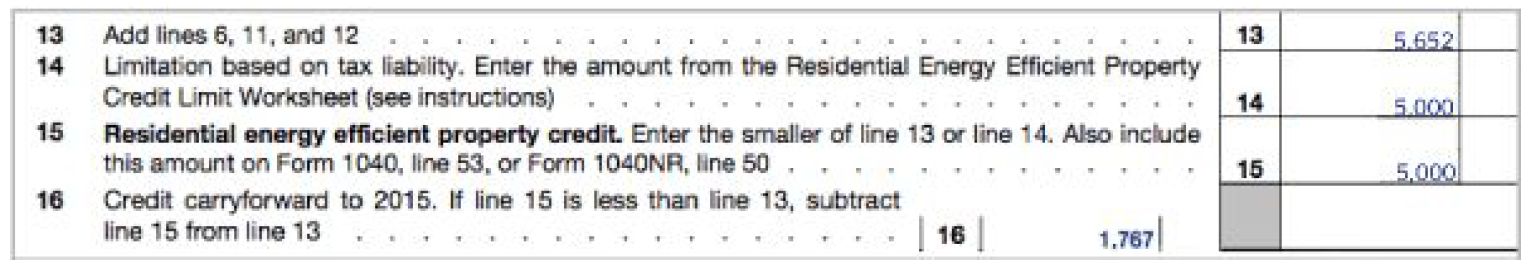

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Pin By Rosemary Gabourie On Truths Within Truth Accomplishment Unfinished Business

How To Claim The Solar Panel Tax Credit Itc

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Pin By Marianne On Dream Home Design Dream Home Design Infiltration House Design

Id Card Template Photoshop Best Of This Is Utah Usa State Drivers License Psd Shop Id Card Template Drivers License Doctors Note Template

When Did The Andes Mountains Form Geology Teaching Geology Earth Science

Instructions For Filling Out Irs Form 5695 Everlight Solar

Instructions For Filling Out Irs Form 5695 Everlight Solar

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Claiming Your Residential Energy Tax Credit Blue Raven Solar

Solar Power Supplies 10 Per Cent Of Japan S Peak Demand Solar Power Plant Solar Renewable Sources Of Energy